Why the book was written?

This book is especially for the teenagers who don’t have an idea about money and how they should invest the money in a proper way. A must-read book for everyone who wants to achieve financial freedom. The author has shared his life experiences when he was a teenager and his learnings from Rich dad. As the lessons mention here can be learned by another age group also, so don’t worry!

Main important lessons about money and the major life lessons we don’t learn in school, so most of the things we learn outside of our school. Every school must teach lessons about money, investing, planning, and earning. Because of lack of knowledge, most of the students remain poor and suffer from financial freedom. That’s the main reason why the author has written this book.

Style of Learning-

There are different learning styles that we follow to learn new things. Some students can learn by doing or by reading and then doing. The author had described different forms of learning style.

Verbal Linguistic intelligence- It means to have a great interest in reading books and to learn different languages, teach others as well.

Numerical Intelligence- This category suggests that you are smart enough in mathematics and like to play with numbers. Generally, take decisions based on the data.

Spatial and Musical intelligence- Doodling shows that you are passionate to convert your imaginations into reality with more creativity. Musical intelligence shows that you are relaxed and calm when you spread beautiful rhythms and music.

Physical Intelligence- Knowing the importance of the body and exercising it regularly to perform better.

Interpersonal and Intrapersonal intelligence- Interpersonal means to know your friends clearly and is very genuine with them. So you make friends easily. Intrapersonal means knowing yourself, control the mind, and responsible for all the incidents in your life.

Natural intelligence and Vision- Natural intelligence refers to be in nature’s influence and like such type of environment to learn new things. Vision means to control the situation and taking actions according to it.

Find out your learning style and make it stronger gradually. To balance some of them you have to do activities related to that intelligence like reading books, preparing your monthly budget, spending some time in self-reflection, or thinking like an intelligent follower to become a great leader.

Finding your interest- You have to find in which area I am good at, which things you like to do the most? Find out some great opportunities and follow your path. You will see the money-making roads that will lead to great riches. The most important thing is to change our mindset towards money and think there are many opportunities, I just need to find it out. Write down your goals daily (in present tense) and you will the change in your in few weeks. The author is telling us to use our brain at our highest potential to make it stronger. Having said that he have given the two statements:

“I can’t afford the things I want.” and the other “How can I afford the things I want?” In these two statements, the first one stops your thinking and the other make you think to get what you want. So always look for solutions and you will find the answers for it.

The Most Common Thinking-

What our family members and most of the friends tell us to get a good education, earn a degree, get a proper salary, work harder to get a proper salary, and marriage with your loved one. They don’t know we can do beyond that also. The poor people don’t have knowledge of money and investing wisely so they remain poor. But the rich are very open about money and willing to help people who are in need of money. They don’t work for money instead money work for them.

The major difference between rich and dad poor dad was, poor people, try to avoid the subject of money, having low thinking about money, avoid taking risks, to get a good job with a good salary is their goal. On the other hand, the rich are totally opposite they tell, take calculated risks, work hard to build your own business, invest in self-learning, have big goals in life, and find ways to add an additional source of income.

Focus on Learning, not on Earning-

The rich dad told the author, work to learn and not to learn. In whatever field you are working, learning from your current job and find opportunities to make your own business. Whatever the income may get you, complete your responsibility and you will feel great. Because what lessons your work teaches you are more important than just working for money. You want a job that pays you a high income but you don’t focus on learning that will give you great returns. Instead, focus on a long term game. Don’t let money control you, instead gain control over money.

“If you do not need money, you will make a lot of money” – Rich Dad

Let the Money Works for You- Rich dad told, keep your eyes open to see business opportunities and to become rich. Make your brain stronger and stronger to attract money in your bank a/c. What business opportunities do you see? See your good qualities and find ways that you can offer to people, it can be working as an advisor, writer, teacher, or developer. Find in which field you are passionate about and find the opportunities where money can be made even when you are not working.

Types of Incomes-

Ordinary Earned Income- This is the income where you get a monthly salary and you have to work hard to increase it. Most people are engaged in this type of income.

Passive Income- This is the income where you are not physically present but the money is working for you. It is a type of investment in something like purchasing stocks, real estate, business, and the most important Learning. You get returns of this investment’s lifetime, it is very beneficial.

Portfolio Income- Investments in stocks and bonds come in this type. It is also a kind of passive income for you.

Investing Intelligently- The author is telling us to invest in assets and not in liabilities. The assets are those in which the money keeps flowing in and also we get a higher price when it is sold. This generates a passive or portfolio income for us. Liabilities are those things that spend your money like anything and you don’t even know it. For example EMIs, car loans, taxes, and other monthly payments. Keep your asset side stronger than your liabilities. See all the liabilities around your room and calculate what amount of money you can get by selling them. Invest in assets to attract more money and avoid buying unnecessary things. So what’s your choice, Assets or Liability?

Understanding Cashflow-

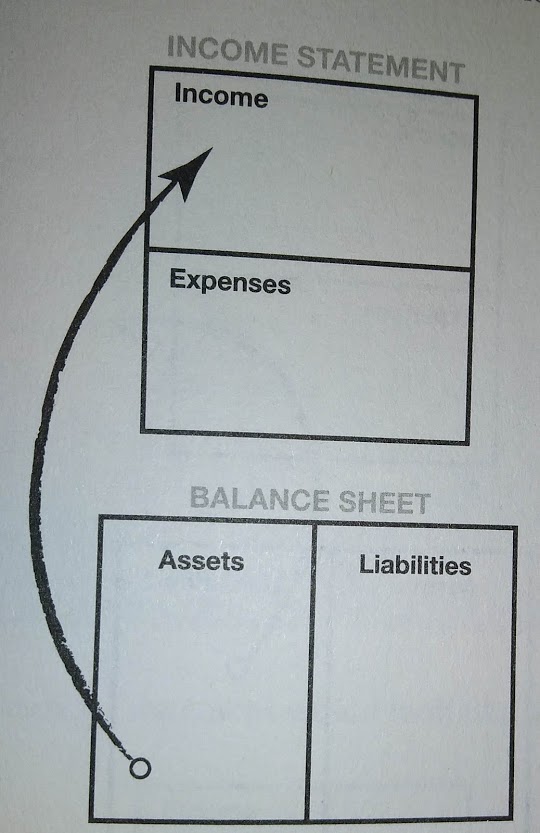

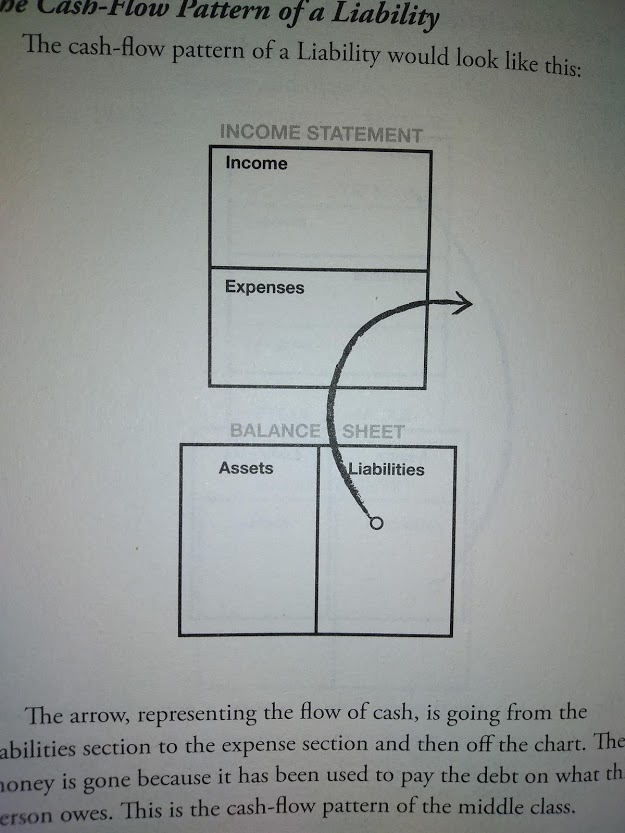

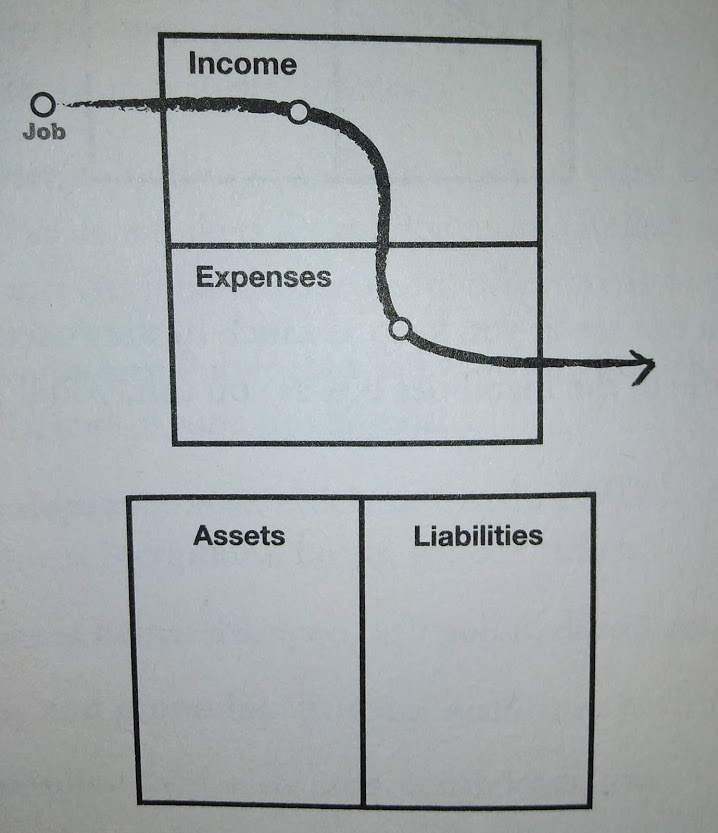

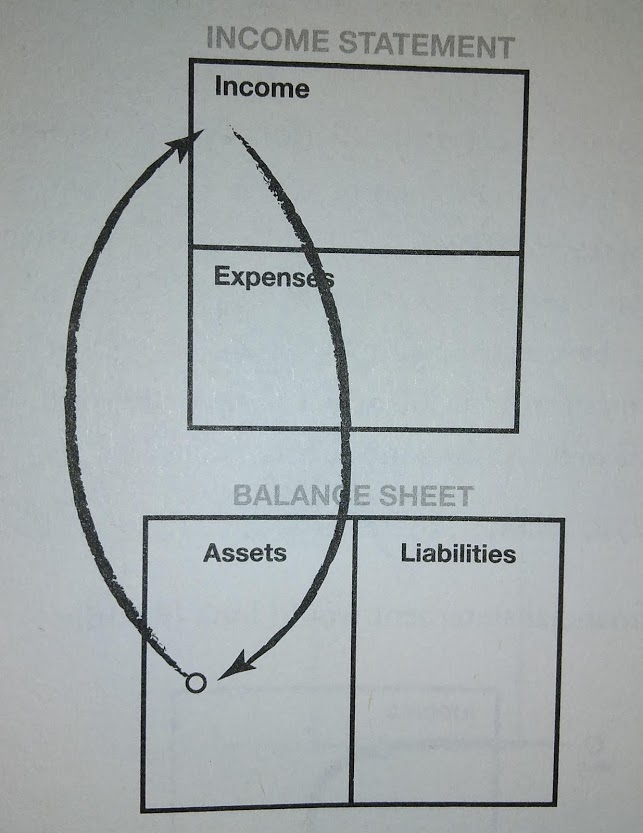

In this cashflow, the author has described the balance sheet and income statement. Income statement means profit and loss statement and balance sheet means the relationship between assets and liabilities. The author has described different types of cashflows to understand clearly.

The cash flow of an Asset- In this type, the asset is making money for the person without making any effort. It is a positive signal for income growth.

The cash flow of Liability- The money has to spend on expenses due to a lack of investment knowledge. It is giving a signal that the most of money has gone into expenses. This is of a middle-class people.

Poor dad Financial Statement- The poor dad spends all of his income on paying his expenses and a very low amount of savings. This is because the asset side is not stronger.

Rich dad cash flow- The stronger the asset side, the more money you will get and the lesser will be the liabilities. Invest more in assets and be rich.

Track your Money- Track the spending of your money, where are you spending the most, and why are you spending? Is it necessary or not? Do not spend on the things that you don’t need, it will just occupy the space and lose your money. Question yourself before buying things, Do I really need it or it is just a waste of money? After practicing you will save a lot of money and you can invest this money in buying assets (passive income). Make your budget and calculate whether your assets are more than the liabilities or not, if not why? If you are saving less amount of money then it is time to look after your assets and start increasing them.

What Games teach us?

The author is telling to play games like Monopoly to purchase houses and buildings and collect the money by giving them on rent. You will get an idea of the concepts explained above and you will know how it works in the real world. We should buy more assets and make a passive income for us to get out of the rat race. Do not get stuck in paying monthly bills, worried about loans. Make your life as you want it, satisfy all the wants and let the money work for you! The author has invented a game called CASHFLOW and encouraging all of us to play these games. This game will give you some money-making opportunities, investments and you have to decide whether to take it or not and see if your assets are more than your liabilities. Play this game to experience the actual financial situations, you will enjoy it!

Going on Field Trips- These are not the field trips that you generally go with your school friends. It is the field trip that will teach you how money is managed in the real world. Do the following things:

- Do a monthly budget for your family and calculate what are the expenses and savings that remained in the account.

- Go with your parents to the bank and see how they deposit the cheque into the bank, what are the requirements to deposit and if possible ask your parents to open your bank account.

- See the businesses around you, like the retailer, how he manages the shop, finance, and customer. What will be his monthly income? Is it a profitable business or not? See all the things around you and find the opportunities where you can start your business.

Different Ways to make Money-

Some of the teenagers think that they cannot start their business. It is not like working in a company for a full-time job. Instead, you offer a skill in which you are good at and can make money from it. Find the jobs in your area that you can do which have great opportunities for learning. Take your parents into consideration when you wanted to work. Take their permission and tell them why do you want to work? What about your studies, will you manage them? Answer all these questions and have trust in your parents. Different kind of jobs you can offer are:

1. Start your own Blog.

2. Work in your family business.

3. Get into writing books.

4. Start your own YouTube channel.

5. Repairing the laptops or computers.

6. Video Editing or graphic design.

7. Formatting the documents to an agency.

8. Teach the students in your area.

And the list goes on. You will find a lot more than the opportunities mention above just make sure you learn something from your job and further you can start your business. Search on the internet, take advice from your parents or relatives and find the jobs that match your skill and interest. To develop your skill in that job or field, find a perfect guide who will teach you step by step, trustworthy, and having the knowledge about that field. You will learn faster with your guide rather than learning by yourself because you don’t know whether you are learning correctly or not. So, always a mentor is recommended.

Making the Growth of your Money-

The author has described the piggy bank approach to grow our money in a steady way. Everyone should have a three piggy bank for different purposes. Let’s take a look at each of these.

Piggy Bank of Charity- To donate the money to the people who need it the most. If you give, give, and give you get 10x back. Help others in a way that anyone doesn’t know that you are helping. In today’s times there is a lot of fraud in charitable organizations, so investigate properly and make sure you are helping directly.

Piggy Bank of Savings- You should have a backup of savings that you can use when there is an emergency. But putting all your income in these places will make only some amount of money because you get very low-interest rates on your money, instead invest in assets.

Piggy Bank of Investments- You can invest your money in buying books, courses, workshops that will teach you a lot about your work, as an investment in learning is the best investment. Have all these piggy banks and focus more on investments. Make sure your income is divided and put into these piggy banks to grow your money. Don’t focus more on savings, invest your money on the things that will give you endless returns even if your savings are little. After investing in your assets, it will provide you more money than you had earlier. People neglect such opportunities and end up making no money, don’t do such mistakes.

“Money is the Power, Use it Wisely, to get Rich”

The Final Chapter of Debt-

A credit card can do anything with your money, it can lose your money or you can make money by buying assets and make a passive income for you. Some things to be remembered while using a credit card. When you use a credit card and avoid paying in cash, you will spend like anything you want, you will not have control over it because there is very little effort in paying. You buy the unnecessary things that are not needed and when the bill comes, you pay the minimum amount and they keep charging high-interest rates. So, avoid making minimum payments and pay it in full amt. As a result, it will benefit you for buying assets to add an additional source of income. Track your money and decide your future, save the money for assets, not for the liabilities and you will soon be becoming rich.

Whatever things I told you in this review will help you to achieve financial freedom and create your own future by choosing the right habits. Your thinking might have changed, you must be thinking, I can also grab the opportunities around me. You can do anything and can create your own destiny, just have to follow the right track and you will be ahead. If you are a parent then gift this book to your child or a teenager then read this book, it will teach you some important lessons about money that are not taught in school. If you like the review and learned something new then share your thoughts in the comment section. Thank you for reading my article!

Make sure you buy this book from Amazon.

I will surely foreward this post to all of my pals! Its very respectable and a very decent check out!

Thanks for sharing 😊

Well, that is my very first visit on your weblog! Were a group of volunteers and beginning a model new initiative in a group inside the same niche. Your weblog supplied us helpful data to work on. You might have carried out a marvellous job! Anyway, in my language, there are not much good supply like this.

Thank you to all for reading my article! You can subscribe here.

Just a fast hello and also to thank you for discussing your ideas on this web page. I wound up inside your weblog right after researching physical fitness connected issues on Yahoo guess I lost track of what I had been performing! Anyway I’ll be back once again inside the potential to check out your blogposts down the road. Thanks!

Hello.This article was really motivating, especially since I was searching for thoughts on this topic last week.

Thank you for your Feedback! 😊

I believe you have produced a few rather interesting points. Not as well many others would really think about it the direction you just did. I am really impressed that there is so much about this subject that has been unveiled and you did it so nicely, with so considerably class. Brilliant one, man! Very fantastic things right here.

Thank You for your Feedback!

Thank you!

The style that you write make it really trouble-free to read. And the design you use, wow. Its a really good combination. And I am wondering what is the name of the template you use?

Thank you for your feedback!! Its Divi Theme

This design is steller! You certainly know how to keep a reader entertained.

Between your wit and your videos, I was almost moved to start my

own blog (well, almost…HaHa!) Great job. I really enjoyed what you had to say, and more than that,

how you presented it. Too cool!

Thank you for your feedback!!